The average Toronto home price has risen 70% in the past 20 years and 22.6% in the past year alone.

With such substantial growth, the right real estate investment can lead to a sizeable paycheque. Even if real estate isn’t your day job, buying or selling your home at the right time can be a pivotal stepping-stone for your personal financial growth.

Is there a Toronto real estate bubble?

The Toronto real estate market is under the microscope, and it is with a good reasons.

Existence of a bubble in real estate market might convince some people that housing prices are essentially operating in their own world; not impacted by what’s happening in regional or global economy and politics.

If you’re buying property in a bubble, you can risk overpaying and being cursed with a high-priced mortgage for years to come. As a seller, you can make significant profits; but, if you sell too soon you might leave money on the table and risk not maximizing your revenue.

For renters, the news is dire: as rental prices are rising quickly with average 1-bedroom units reaching almost $1,800 per month in 2016. Meanwhile, those investing in rental properties can take advantage if they have the capital to afford such properties. A recent Financial Post article cites a tight vacancy rate in Toronto that is close to one per cent, pushing rental unit valuations up as high as $300,000 and increasing the overall investment value.

Let’s first answer this: what’s happening in the real estate market across Canada and more specifically, in Toronto?

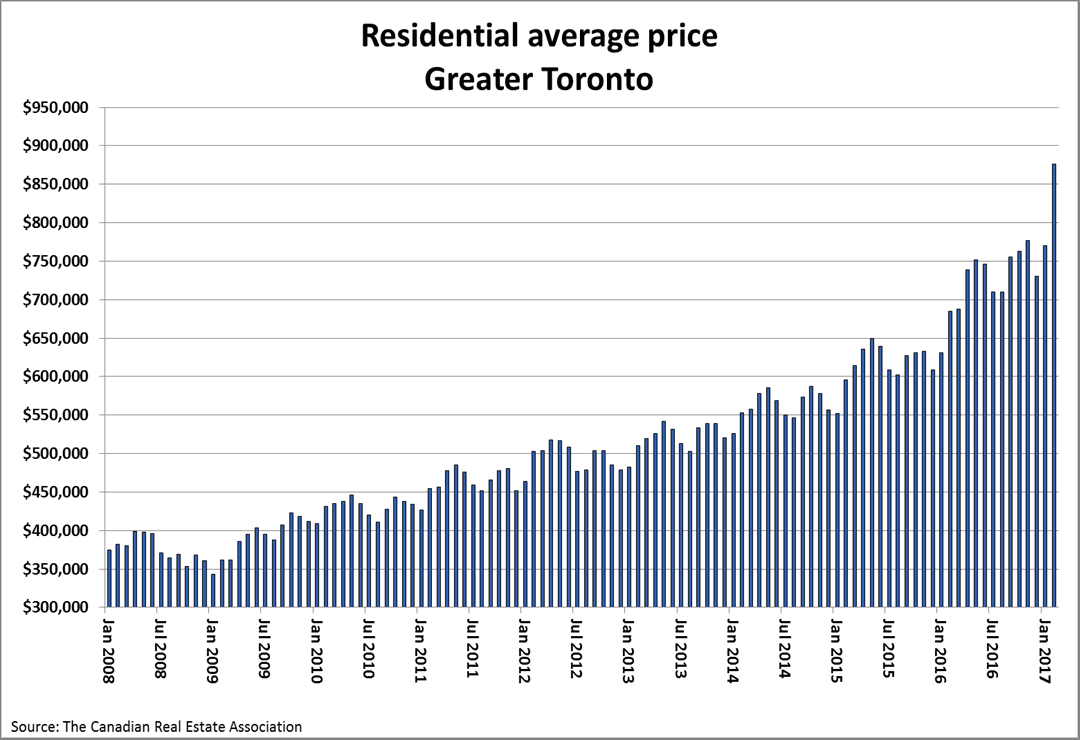

According to the Canadian Real Estate Association reports the average price of the Canadian homes sold in January 2017 as $470,253 (see figure below). That’s equivalent to price at the same time in 2016. By the end of February 2017, the average price jumped by 10% only in 1 month.

[xyz-ihs snippet=”Canadaaverage”]

Source: www.crea.ca

As the Toronto Real Estate Board reports an average Toronto home sold for closer to $773,000 in January 2017, compared to around $628,000 in January 2016, and 680,000$ in February 2016. Interestingly, in February 2017, housing market in Toronto reached to a new high record of $877,000; almost 23% increase in price over one year. This is staggering in comparison with the national averages, indicating Toronto real estate could indeed be operating within a bubble.

As a seller, by investing on an average home in Toronto, you could have earned more than $100,000 over the past year, if you had sold your property at the right time. On the other hand, as a buyer you would have to shell out more money by waiting to purchase. But, how can someone predict what is going to happen next?

Investors may see attractive opportunities in these figures, using similar industry analysis and empirical evidence to support their investment decisions. Professional services in the real estate sector have no doubt been on high alert, as the real estate agents, mortgage brokers and investment teams with the fastest, most accurate data will win higher quality opportunities and more profit. Now, innovations in technology and tools are helping support these decisions.

The rise in popularity of “robo advisors” in the UK and US has trended upward, with 43% of the high-net-worth segment using automated wealth advice to support their investment portfolio. Similarly, new technology and apps can better calculate the fluctuations in unpredictable real estate markets like Toronto, and investors will be relying on a higher quality of data-driven analysis to improve their investment decisions.

This software predicts intense growth in Toronto real estate, but timing is crucial

Gnowise technology analyses features affecting real estate market to compute housing price in different regions of Toronto. We develop data analysis algorithms in order to scientifically predict price fluctuations in the short-term real estate market in different regions of Toronto. Our massive database includes most important parameters that have an impact on real estate market. That means that if you’re in the market to buy or sell, our data is like a real estate crystal ball.

Studying the abovementioned information from real estate boards or those from real estate experts is important, but those information is solely based on average sell prices, you will still be in a dark room when the familiar trends start to change. The biggest truths lie in deeper calculations that only predictive science can provide. If you’re looking to avoid (or stir up) a bidding war like the house in Brampton that reported 532 showings and 82 offers, having accurate insight about the market is crucial in order to jump into the business at the right time. Knowing about the price fluctuations in your region of interest by having access to predictive data can give you an upper hand in your investment.

Looking at 10-year average condo price in the interactive figure below developed by Gnowise, you’ll immediately notice some points that stand out.

- There are many spikes and valleys. Predicting these without data analytics could be impossible.

- Two or three significant price changes occur every year. For example average condo price has raised by 13% between February-May 2015.

- When prices rise, the increases can be very significant.

- Over time, prices are always going up, with the exception of 2008 when the economic crisis hit all markets.

- Since January 2016, the slope in price change has increased significantly.

[xyz-ihs snippet=”TOaverage”]

Based on deep data analysis, Gnowise data can offer valuable predictions for the coming months.

Prepare for a real estate spike in mid-2017

As you can see in the interactive figure below, the first half of 2017 includes a fast-moving upward price adjustment. By May or June, you’ll see a significant spike in real estate prices, where the average condo will sell for over $490,000.

Here’s the big news: it could peak there!

[xyz-ihs snippet=”TOaverageZoomed”]

If you’re selling, consider getting your property listed in spring to take advantage of maximum prices. If you’re buying, do it as soon as possible to avoid the sharp increase; otherwise, it might be best to wait until later in the year when prices decline.

Watch for price adjustments by the end of year

By summer, the price decline will be well under way. Mid-year will see a price plateau before further decline into the fall months.

For buyers, you’ll have more success later in the year if you want a lower price point, but that may also mean you’ll be viewing houses alongside many other buyers thinking alike. (Remember those 500+ viewings for one house?) For sellers, you may not receive as high a price for your property later in 2017, but at the very least it will be on par with what you would have received at the beginning of the year.

Agents and investor decisions

Real estate agents should therefore post the majority of listings in the first half of 2017 to maximize profits. Then focus on your buyer segments after summer when the competition and viewings will be more reasonable. Consider sharing this information in customer newsletters and mailings to advise clients about best times to buy and sell. This could be the extra push that clients need to move forward with their real estate decisions.

Investors will see some noteworthy opportunity in this analysis. With such dramatic changes in short time frames, the real estate year will be flooded with potential for profit.

Of course, pricing and data are constantly changing, and Gnowise data predictions are, too. That is why Gnowise constantly evaluates new data points to provide the most accurate analysis. These predictions help make informed investment decisions with the most accurate modeling available, but cannot be held as a definitive statement on whether you should buy, sell or wait for pricing to change.

You can use this information to help with your assessments, consult with your real estate and investment professionals, and make sure you’re making an enlightened investment decision.