Imagine there was a crystal ball for real estate valuations. Investors would know exactly where to put their money. Real estate brokers could target key geographic areas with precision. And commercial bankers could get their clients the highest returns.

That crystal ball exists, thanks to predictive analytics — which is what we use to power our Gnowise software. This technology is on the fast track to becoming a commercial finance superhero — making banking professionals big winners when it comes to price fluctuations in the real estate market. In turn, this can make your clients bigger returns.

Here is one of the challenges that banking professionals are facing in the real estate game, and how can Gnowise predictive analytics help make better investment decisions.

Challenge: Waiting for out-dated information

Your ability to service a client effectively suffers when you can’t access data quickly. Whether it’s the system that is slow or the data that is already out of date by when you get it, your clients deserve better.

Gnowise Solution: Access accurate valuations at your fingertips

Predictive analytics isn’t brand new, but the advancements in big data, machine learning and AI — and harnessing their capabilities all at once — are what have opened the floodgates in the field.

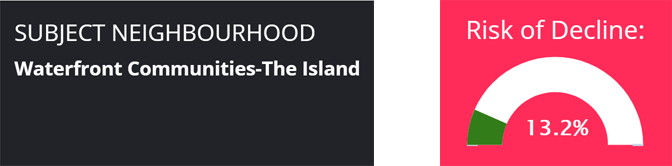

With Gnowise, the speed and accessibility to data is what is truly innovative, and having quality data at your fingertips at any given time is a powerful ability. You get a single source for all your predictive real estate data, rather than having to deal with multiple data sources and then analyze that information. The model predicts the most impactful variables in each neighborhood, providing banks with the tools for smarter decision making not only in the real estate market but also other linked markets.

Gnowise also provides agile scientific appraisal for faster mortgage risk analysis and approval. Plus integrations with other software provide incredible flexibility, so it can work with your existing software and multiple systems at once — saving banks thousands of dollars on hard costs alone.

According to Salesforce CEO Marc Benioff, predictive analytics is in its infancy, and it is a tool that every company is going to be clamouring for in the near future. “This will be the huge shift going forward, which is that everybody wants systems that are smarter, everybody wants systems that are more predictive, everybody wants everything scored, everybody wants to understand what’s the next best offer, next best opportunity, how to make things a little bit more efficient,” according to Benioff.